Poloniex trade volume and market listings

.jpg)

However, the interface itself is particularly enjoyable and simple. We’d recommend this platform since it has low trading fees and over 400 different cryptocurrencies that you can trade. It also lets you do margin trading, lend cryptocurrencies, and has multiple ways to trade. But, we’d also suggest you consider the security factor since Poloniex as discussed does not have a good reputation with its security. Unlike traditional brokerage firms, cryptocurrency exchanges are not members of the Securities Investor Protection Corp. (SIPC).

App support

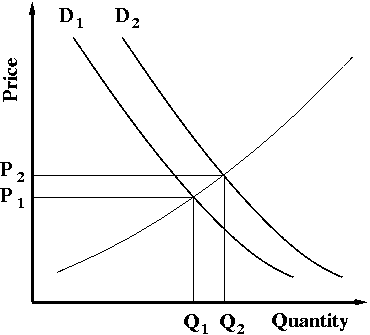

Poloniex lets users buy crypto with a bank account, Visa, Mastercard, Google Pay, or Apple Pay. It also features trading platforms suitable for beginner to expert traders and works with decentralized financial products, including a decentralized exchange. Poloniex has devised a fee structure for both market makers and takers. Naturally, makers pay notably lower fees (makers create new orders, takers take existing orders).

The platform not only allows you to exchange cryptocurrency but also to trade on margin – something rarely offered in the cryptocurrency market. Poloniex is one of the biggest cryptocurrency exchanges in the world. It has been around since January 2014, so it was actually one of the early birds on the market. Poloniex Earn enables gives the option for users to passively earn crypto rewards by staking their holdings. Poloniex has expanded its product offering to include a margin exchange and futures contracts for those that want a platform to leverage trade crypto.

- The Poloniex verification process depends on the user’s tier level.

- If you don’t feel comfortable searching for answers to questions with help sections, you may prefer an exchange that offers more options for customer support.

- Founded in 2014, Poloniex is a cryptocurrency exchange and service provider based in Boston.

- Poloniex has integrated TradingView, one of the most popular online charting platform for crypto.

- Kevin started in the cryptocurrency space in 2016 and began investing in Bitcoin before exclusively trading digital currencies on various brokers, exchanges and trading platforms.

- You have to input all the above details and once done; you’ll receive a confirmation email with an activation link.

Poloniex Review

- The U.S. Treasury Department’s Office of Foreign Asset Control (OFAC) has revealed that crypto exchange Poloniex will pay $7.6 million as a settlement for its sanctions violations.

- They also keep updates for anything strange happening on their website.

- Poloniex is one of the biggest cryptocurrency exchanges in the world.

- There are several platforms on Poloniex available that may be appropriate for different trading experience levels.

- That’s why it’s crucial to spend time getting to understand the features that are most important to you.

- The infamous Trollbox on Poloniex allows traders on the platform to participate in a community to share trade ideas and thoughts.

The margin feature allows traders to borrow funds to increase the size of the trading position. The funds in your account remain as collateral for your margin trades. One of the unique things about Poloniex is that it doesn’t feature any fiat-to-cryptocurrency trading. Users aren’t able to trade their cryptocurrencies against fiat currencies. The ability to hedge does exist though, thanks to the stable coins (such as the Circle based USDC).

Ratings and reviews

On Nov. 10, 2023, Poloniex was hacked, and the exchange suffered a $100 million loss. The international exchange has its own geo-restrictions, including the United States, Cuba, Iran, North Korea, Sudan and Syria. In May of 2021, Poloniex was charged by the Ontario Securities Commission for violating Ontario securities law.

Kraken Exchange Review : Is Kraken the Right Cryptocurrency Exchange for You?

To deposit, click on the “Balances” button in the top right corner on your navigation menu. Note that Poloniex doesn’t allow you to deposit fiat currency as it is a strict cryptocurrency to cryptocurrency exchange. The exchange has an easy to understand user-interface which makes trading seamless and easy. Below, we take a complete look at how to open an account and how to begin trading on Poloniex. Poloniex is a well-known veteran cryptocurrency exchange based in the United States. Poloniex’s active trading platform includes a chart with a number of indicators.

.jpg)

The cryptocurrency Poloniex Crypto Exchange exchange charges and deducts its fees on a per-trade basis. This is somewhat beneficial for the trader because the more volume he trades, the lower the fee is going to be on subsequent trades. Today we will review – Poloniex – a digital asset trading exchange registered in Seychelles. In this review, we will be discussing in detail Poloniex features, fees, Pros, Cons, security, fees, and much more. Exchanges were reviewed on points including security, fees, number of cryptocurrencies available, and more.

Share this crypto insight with your network!

Poloniex is a cryptocurrency exchange that combines low trading fees with a list of over 400 supported cryptocurrencies. Additionally, we like that Poloniex is a decentralized exchange, and offers margin trading, lending, and other crypto products. With its low fees, a wide selection of assets, and useful features, this exchange could potentially meet all needs of many crypto traders. Poloniex may seem like an ideal cryptocurrency exchange for nearly any investor. Low trading fees and a list of 400+ cryptocurrencies make this platform an attractive option.

You can get the Apple version in the App Store, and the Android version is listed in Google Play or offered as a direct download. The apps allow you to manage your account, view crypto balances, and trade supported currencies. Users can also trade some volatile currencies like Baby Dogecoin, and Dogs of Elon.

Coinbase is registered with the SEC to operate in the U.S., while Poloniex no longer does. Poloniex lists 587 cryptocurrencies, only 76 of which have a trading volume of more than 0.01% of the total volume on the exchange. This is likely the main reason its trading volume is so much lower than Coinbase and many other exchanges. In January 2022, Poloniex ceased all trading in Ontario, announcing that the territory had become a restricted jurisdiction.

.jpg)

.jpg)

.jpg)